-

Tel:+86 18948187408

The 2024 "Black Friday" and "Cyber Monday" global shopping carnival season has come to an end. Major platforms have released eye-catching battle reports, and consumers' purchasing power has once again demonstrated amazing potential.

Global consumption frenzy: preview of data highlights

Image source: Livemint.com

According to foreign media mint, the total amount of U.S. e-commerce consumption on Black Friday was US$10.8 billion, a year-on-year increase of 10.2%, and the total amount of online consumption worldwide also reached an astonishing US$74.4 billion. On "Cyber Monday", it reached a new high, with the total amount of e-commerce consumption of U.S. consumers in a single day reaching US$13.3 billion, a year-on-year increase of 7.3%. During the peak shopping period (20:00-22:00), consumers spent up to US$15.8 million per minute. (Data source: Adobe Analytics)

The popular products purchased are very rich, from electronic devices such as Bluetooth headsets and smart speakers to household appliances such as smart home devices, electronic scooters, and electronic game consoles.

Emerging e-commerce platforms such as TikTok Shop and Shopify have performed well. For example, TikTok Shop's sales in the US market exceeded 100 million US dollars on Black Friday. At the same time, TikTok Shop's US payment GMV increased by 176% compared with last year, and the US single-game sales record of 2 million US dollars was also broken. Shopify set a new record with sales of 11.5 billion US dollars, a year-on-year increase of 24%. T-shirts, skin care products and vitamins have become consumers' "shopping cart regulars".

According to Amazon's public information, during the event from November 21 to December 2, Amazon's sales and product sales volume both broke historical records. At the same time, this is also the largest event for Amazon's third-party sellers. During the event, more than 60% of Amazon's sales came from third-party sellers. In terms of categories, electronic products, toys and beauty products are some of the most popular categories on Amazon's US site.

Behind the sales: insights into hot-selling categories

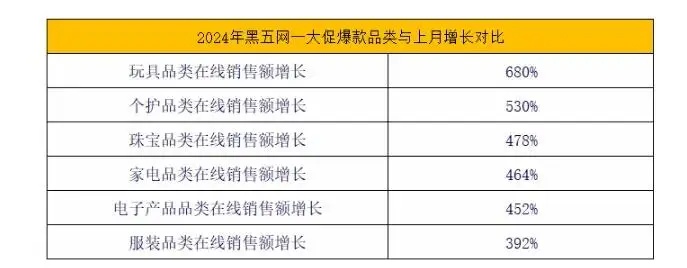

Adobe Analytics data shows that during the "Black Friday" in 2024, consumers' shopping enthusiasm is concentrated in categories such as toys, cosmetics, skin care products, jewelry and home appliances.

Image source: Adobe Analytics

Among them, toy sales surged 680%, while jewelry and home appliances recorded growth of 478% and 464% respectively. These data fully reflect the strong demand of consumers for holiday gifts and home improvement products.

At the same time, the sales of home appliances also increased significantly, showing that while consumers pay attention to small items, they gradually include large items in their shopping lists, and the consumption trend is more diversified.

Amazon US Home Furnishings: Black Friday sales were $450 million, a year-on-year increase of 5.03%, accounting for 10.4% of all category sales, ranking first. Cyber Monday sales were $430 million, a year-on-year increase of 2.1%, and the total category share was also 10.4%, ranking first, but its overall conversion rate was significantly lower than last year's Black Friday Cyber Monday.

Amazon US Toys: Black Friday sales were $310 million, a year-on-year increase of 1.5%, accounting for 7.2% of all categories, ranking third. Online sales on the first day of the online shopping season reached 290 million U.S. dollars, down 0.99% year-on-year, accounting for 6.9% of the total category, ranking third. Although the self-operated GMV has declined, the growth rate of third-party sellers has remained stable.

Amazon US clothing category: Black sales of 310 million U.S. dollars, up 7.17% year-on-year, online sales of 330 million U.S. dollars, up 5.07% year-on-year, consumers pay more attention to holiday wear and practical items.

The above data comes from Amazon.

Peak season challenges for cross-border sellers: return issues cannot be ignored

After the carnival, the return issue has become the "number one problem" for cross-border sellers. According to a report released by the National Retail Federation (NRF), the total amount of returns of U.S. e-commerce products is expected to reach 890 billion U.S. dollars in 2024, and 69% of consumers said they would return goods after purchasing them for specific activities, an increase of 39% from 2023. In addition, 46% of consumers said they would return goods multiple times a month, an increase of 29% from last year. This phenomenon shows that consumer return behavior is becoming increasingly common, bringing pressure to sellers that cannot be ignored.

Amazon also stipulates that goods purchased between November 1 and December 31, 2024 can be returned before January 31, 2025, and the return period for Apple brand products is January 15, 2025. The policy applies to seller delivery, FBA and Amazon retail orders. While this policy provides consumers with flexible return options, it also makes sellers face a longer return window period, thereby increasing the complexity of return management.

Therefore, in high-frequency promotions, returns, label changes and secondary sales have become the links that sellers need to focus on. For cross-border sellers, returns not only increase operating costs, but may also affect inventory turnover and customer satisfaction. How to efficiently handle overseas returns has become one of the keys to improving competitiveness.

U-Speed provides professional global return services

Aiming at the pain point of returns after the peak season, U-Speed provides a one-stop global return service to provide cross-border sellers with efficient and safe return management solutions.

Global coverage: U-SPEED's service network covers core markets such as Europe, America, Australia, and the Middle East. It has 26 return warehouses on five continents around the world to meet the diversified needs of sellers.

Flexible services: Support value-added services such as return label change, re-listing, quality inspection, etc., to help sellers minimize losses.

Full transparency: The entire order process is tracked in real time, and the data can be updated within 48 hours after the operation is completed to ensure the rapid secondary sale of goods.

Professional team: U-SPEED's self-operated overseas return warehouse has a Chinese management team + localized operation team, strictly implements the SOP process, native language communication reduces communication barriers, and provides more efficient services.

Taking the European and American markets as an example, returned goods can be directly transferred to U-SPEED's overseas warehouses, and efficiency can be improved through precise operations, providing sellers with a complete return solution. Whether it is the return of popular products during Black Friday or the logistics needs in daily operations, U-SPEED can escort sellers.

Looking to the future

Although the craze of the "Black Friday Online One" carnival season in 2024 has come to an end, the peak season has not yet ended, and cross-border sellers still have the opportunity to achieve better results in the upcoming Christmas holiday sales. While competing for market share, solving the problem of returns and optimizing operational efficiency will become the focus of future development.

Choosing a professional service provider like U-SPEED can help sellers achieve worry-free returns and efficient operation, so that they can focus more on business expansion and customer maintenance. The competition in the cross-border e-commerce track is fierce, but only by providing the best after-sales service can we truly win the trust of consumers.